Okay, it’s time for another mini civics lesson. The City of Austin officially has a new budget… so what exactly does that mean for you? That’s what we’re talking about today.

Each year around this time, Austin City Council must approve a new budget for the city. Usually, the debate focuses on two things:

- How much money the city should collect from all of us (via property taxes)

- How the city should spend the money it collects – recycling service, homelessness programs, the police department, arts and music initiatives, etc.

First let’s talk about how much money the city will be collecting (aka – what this will cost you).

The new property tax rate, which City Council approved earlier this week, is 44.03 cents per $100 of taxable property value. This is technically a slight decrease in the rate from last year. However, because of rising property values in Austin, you’ll likely still pay more in property taxes this year than you did last year.

So what does a 44.03 property tax rate actually mean? The official estimate is that the average homeowner (with a house worth $332,366) will see an increase in their city property taxes of $66.87 in the new year. When combined with some small increases in city fees (for things like trash collection, electricity, and water), the average Austinite will pay $77.31 more this year for city taxes and fees.

How does this increase compare to previous years?

Although you’ll see an increase in your property tax bill this year, it will likely be a smaller increase than in previous years. According to Texas state law, a city is not allowed to raise the amount of income it brings in (via taxes) each year by more than 8 percent. For this new fiscal year, the city is going to bring in 5.4 percent more in revenue, the smallest increase in recent years.

But that’s not even the whole story… what makes up the rest of your property tax bill?

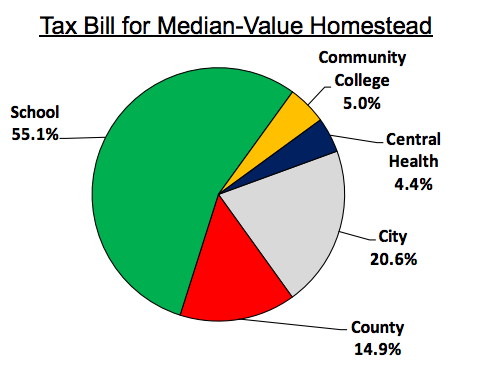

The taxes you pay to the City of Austin only make up about 20 percent of your total property tax bill. More than 55 percent goes to the school district, about 15 percent goes to the county, 5 percent goes to the community college system, and 4.4 percent goes to Central Health.

Property Tax Bill Breakdown for Median-Value Home last year. photo from the City of Austin’s Budget Office.

So, in the new budget year (which begins on October 1st), the average Austinite will be paying $1,317.07 per year or $109.76 per month in just city property taxes.

And yes, if you’re a renter, you still pay property taxes. Unless you have the nicest landlord in the world, they’ll likely be passing along any property tax increase to you and your rent bill.

Okay. Now that we’ve got that settled, let’s talk about where all of this money will be spent.

Our city’s new budget is $4.1 billion, which means that it pays for a long list of things – from Austin Energy (which provides all of us with electricity) to our city’s public parks. To keep things simple, here are some of the highlights. This year’s new budget will:

- Fully fund the Housing Trust Fund (which supports affordable housing) for the first time ever, allocating a total of $5.3 million towards it

- Fund the construction of two new fire stations at Moore’s Crossing and Travis Country

- Dedicate millions of dollars in new funding toward homelessness support programs

- Provide an increase in funding for parks and parks maintenance

- For the first time ever, provide all city employees (including seasonal and temporary) with a living wage of $15 an hour

- Add recycling services (also for the first time) to all of our city’s public parks